- People looking for a discount on foreign currency exchange

- Those who are traveling abroad, studying abroad, or going on a work-holiday

- Those who do not want to carry cash abroad

- Those who do not want to have excess foreign currency when returning home.

Foreign currency exchange is necessary when going abroad.

This fee is surprisingly high.

Exchange fees at airports are particularly high, and it is a hassle to find a currency exchange place outside of the airport.

If you could save those fees, what would you do with them: eat a little better, go shopping, etc.?

The Wise debit card makes this possible.

There is no need to go to a money exchange office, and you can exchange money at a low fee.

It is such a good card that I wish I had it earlier, and I recommend it to anyone who is going abroad.

目次

What is Wise?

Wise is a company based in London, England, that has been providing international money transfer services since 2011.

(Name changed to “Wise” in 2021. Formerly known as TransferWise.

More than 13 million users as of 2021.

At Wise, users transfer and collect the currencies of their respective countries to their Wise accounts, from which they use the currency they need.

Fees are kept low by eliminating relay banks.

(Remittance fee shown on the official Wise website = exchange fee)

Currency exchange is available for more than 50 countries.

(52 currencies as of 2022/10)

The four advantages we have found using Wise are as follows

Two disadvantages are also presented.

Advantage 1: Low exchange fees

Lower exchange fees than local banks

Wise’s greatest advantage is its low exchange fees.

Let’s see how much the exchange fee is calculated on the official website.

In order to compare with the case of exchanging money locally, let’s check Japanese Yen (JPY) → Malaysian Ringgit (MYR).

Wise exchange rates do not include commissions, which are calculated separately.

If you exchange 100,000 yen at Wise

3,401.76MYR

Commission fee is 721 yen (approx. 0.7%)

(as of March 28, 2022). (as of 3/28/2022)

Next, let’s look at the fees for exchanging currency locally.

This time, we chose a “bank” with a better exchange rate than an exchange office.

(Bank in Suria KLCC, Kuala Lumpur)

To convert yen to foreign currency at a local bank [BANK BUY].

It means that the bank buys yen at that rate.

BANK BUY exchange rates are inclusive of commissions.

As of 3/28/2022, the currency exchange is

100 yen → 3.3500 MYR

3,350 MYR for 100,000 yen exchange

Comparing Wise and bank fees.

| Exchange Amount(MYR) | 両替金額 (yen) | Commission Fee(yen) | |

| Wise | 3,401.76 MYR | 99,279 yen | 721 yen |

| Local Bank | 3,350.00 MYR | 97,769 yen | 2,231 yen |

| Commission fee Difference | - | - | 1,510 yen |

(Exchange rate without commission: 1JPY → 0.0342646 MYR)

Wise charges 721 yen (0.8%)

Bank charges 2,231 yen (2.2%)

The price is 1,510 yen lower than that of a bank.

Note that the exchange rate at the local exchange office was 100 JPY → 3.3400 MYR.

At the airport, the exchange rate is even worse.

Considering this, Wise’s exchange fees are inexpensive.

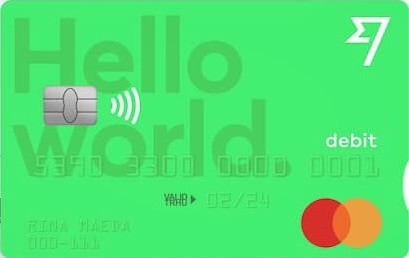

Advantage 2: Cards can be settled by touch

You can use your debit card to pay for shopping only for the account balance in your Wise account.

The card brand is Mastercard.

It can be used at most stores that accept card payments.

The Wise debit card has a touch payment function for smart billing.

With touch payment, there is no need to enter a PIN, just hold the card over the card payment terminal.

Payment can also be made by entering a PIN, which is inserted into the card payment terminal.

By using your card to pay for your overseas travel, you will be able to travel light without carrying extra cash.

It is good to be able to minimize carrying cash for safety reasons.

Advantage 3: Cash withdrawals at ATMs

- ATM cash withdrawals available, low fees

- Save time without the hassle of finding a currency exchange

When cash is needed, withdrawals can be made at local ATMs.

With Wise, ATM withdrawal fees are also low.

If you issue a Wise debit card , there is no withdrawal fee of 100 USD/month.

Please note that the number of withdrawals is limited to two per month for free.

| ATM Withdrawal Amount | Commission Fee |

| Up to 100USD | Free up to twice a month |

| Over 100USD | 1.5USD + 2% over 100USD |

A fee will be charged for withdrawals exceeding 100USD or after the third withdrawal.

*Fees vary depending on the country of issue.

You can reduce fees by mainly paying by card and making fewer ATM withdrawals.

As of 2022, Southeast Asia is going cashless. In 2022, Southeast Asia is also becoming increasingly cashless, and you can generally pay by card except in local places.

Another advantage is the use of ATMs, which eliminates the need to go to a currency exchange.

This saves time by eliminating the need to search for a currency exchange with a good rate.

In Malaysia, ATMs are located throughout the city and are not difficult to find.

If you go to a shopping mall, you will find it.

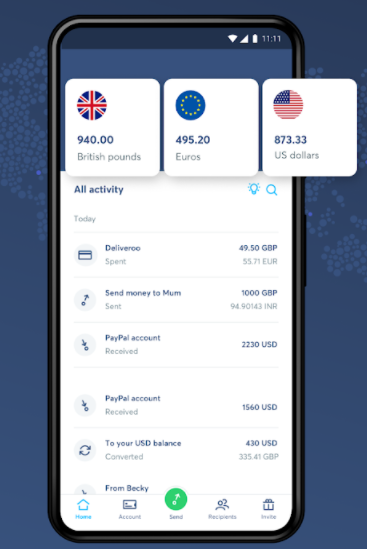

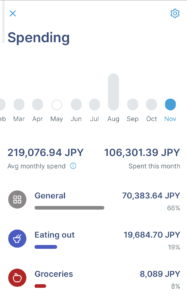

Advantage 4: App-based fund management

You can check your balance by putting the Wise app on your phone.

When a payment is made with the card, it is automatically reflected, and the date of use, name of the store where the payment was made, and the amount of money spent are also recorded, making money management easier.

It also shows the amount used per month.

They are also automatically categorized, making them easy to read and hassle-free.

When the balance is low, you can transfer money from the app.

Disadvantages (1) Card issuance fee

- 9USD card issuance fee

- No annual fee

I have told you about the advantages so far, but there are a few disadvantages as well.

There is a 9USD fee to issue a Wise debit card.

*Fees vary depending on the country of issue.

It may seem a bit pricey for those who only go abroad once.

However, for this cost, you get convenience.

Issuance costs can be recovered quickly due to lower exchange fees.

This is especially useful for those who will be going abroad several times.

There is no annual membership fee.

It takes approximately 14 days to receive the debit card at home after it is issued.

You will need to apply early in accordance with the timing of your overseas trip.

Disadvantage 2: Currencies not available

Major countries not available

Afghanistan, Burundi, Central African Republic, Chad, Congo, Democratic Republic of Congo, Cuba, Eritrea, Iran, Iraq, Libya, North Korea, Palestinian territories, Somalia, Sudan, South Sudan, Syria, Venezuela, Yemen

Wise’s currency exchange does not handle all national currencies.

Wise is available in 52 currencies as of 2022/10.

Please note that it cannot be used if you are going to other countries.

However, it does not seem to be too much of a problem since it can be used in most major travel destinations.

Currencies that can be exchanged are as follows

(Click on image to enlarge)

-1024x531.png)

How to register an account with Wise

- Account registration takes only 5 minutes

Here is an introduction to account registration.

The exchange method will be explained separately.

First, enter the official Wise website.

First, enter the official Wise website.

Registration Procedure (1)

Enter the “email address” to be used for the account.

Registration Procedure (2)

Select “Personal Account” or “Corporate Account.

If you want to use it for international travel, it will be your personal account.

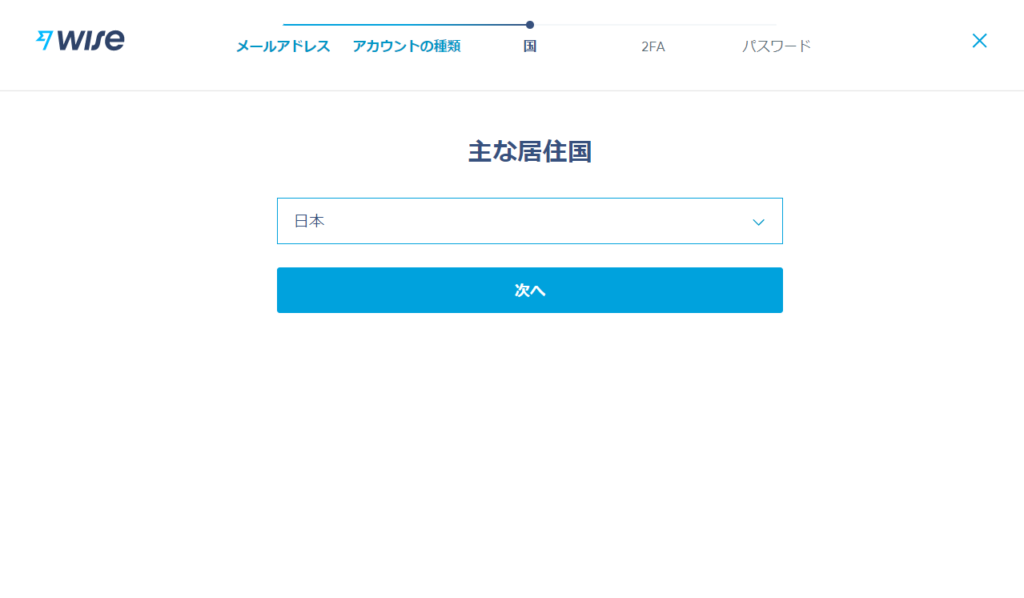

Registration Procedure (3)

Select “Country of Residence.”

Registration Procedure (4)

Enter the “phone number.”

International telephone numbers in Japan begin with “+81”.

If the number starts with 090, then it is +81 90 ×××× ×××× without the 0.

(You can also register by typing +81 090)

*For Japanese phone numbers

Registration Procedure (5)

Enter the “6-digit security code” received in the SMS.

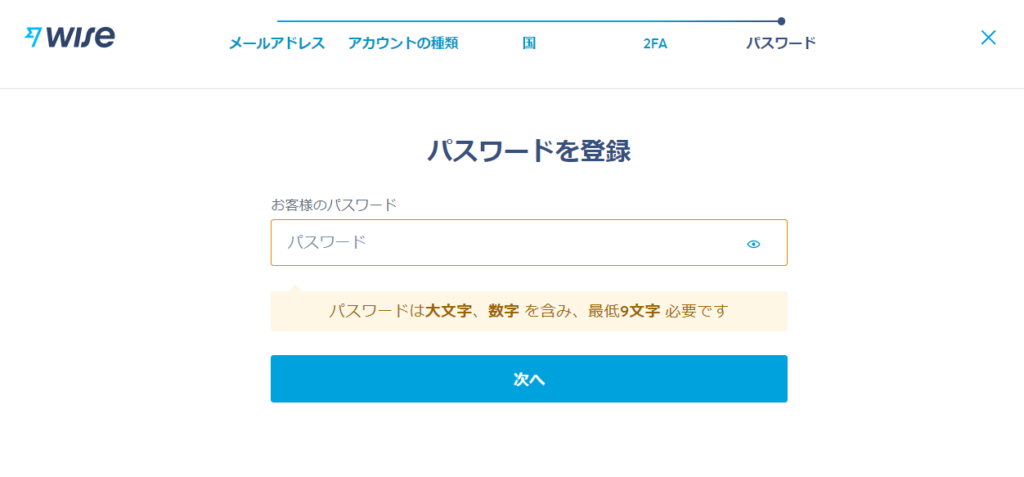

Registration Procedure (6)

Set an optional “password”.

A minimum of 9 characters, including uppercase letters and numbers, is required.

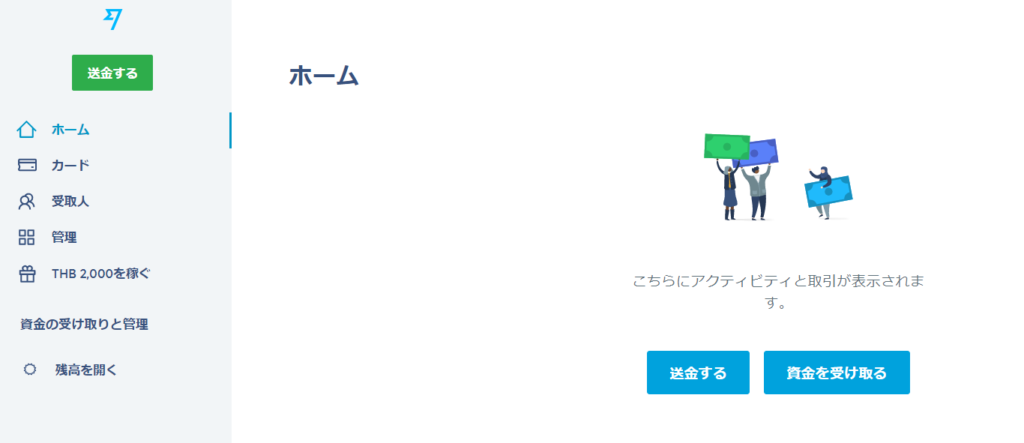

Registration Procedure (7)

Press “Decide Later” to go to the home screen.

Registration Procedure (8)

Account registration is now complete.

Information on how to exchange money will be provided separately.

Finally.

The Wise debit card is a good card to have if you are going abroad.

It is also useful for international travel, business trips, and working holidays.

It’s also great for saving money on the fees you could have saved, and for making your meals more luxurious.

It seems to be an essential item for future international travel.

Please use this card when you go abroad.

Thank you for reading to the end.